Klabin na mídia

10/02/2021

Relações com Investidores e Resultados Financeiros

Klabin reports growth of 36% in adjusted EBITDA in fourth quarter 2020

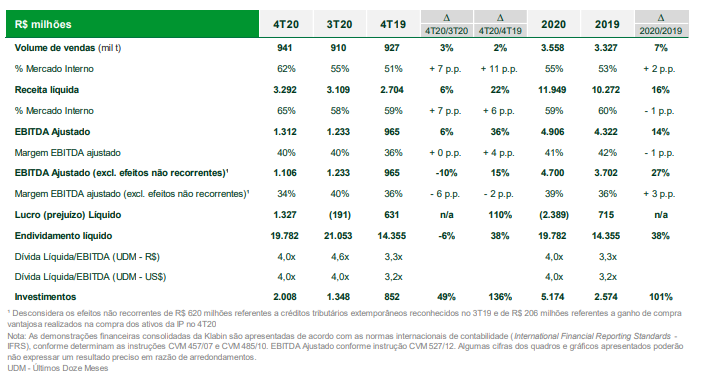

Adjusted EBITDA reaches R$1.312 billion in the fourth quarter of 2020, up 36% on the same quarter last year. In 2020, Adjusted EBITDA advanced 19% on 2019. Net revenue in the quarter was R$3.292 billion, setting a new record and growing 22% on the first quarter of 2019. Total sales volume in the quarter grew 2% compared to 4Q19, considering the sales resulting from the merger of the International Paper assets. Also in 2020, the Company was selected as a component of the Dow Jones Sustainability Index portfolio in two categories, World and Emerging Markets, becoming the only Brazilian company to figure in the World category.

Klabin reports growth of 36% in adjusted EBITDA in fourth quarter 2020

Adjusted EBITDA reaches R$1.312 billion in the fourth quarter of 2020, up 36% on the same quarter last year. In 2020, Adjusted EBITDA advanced 19% on 2019.

Net revenue in the quarter was R$3.292 billion, setting a new record and growing 22% on the first quarter of 2019.

Total sales volume in the quarter grew 2% compared to 4Q19, considering the sales resulting from the merger of the International Paper assets.

Also in 2020, the Company was selected as a component of the Dow Jones Sustainability Index portfolio in two categories, World and Emerging Markets, becoming the only Brazilian company to figure in the World category.

São Paulo, February 10, 2021 – Klabin, Brazil’s largest packaging paper producer and exporter, the country’s only producer to offer solutions in hardwood, softwood and fluff pulp and the leading producer of corrugated board packaging and industrial bags, reported growth of 36% in adjusted EBITDA (Earnings Before Interest, Tax, Depreciation and Amortization) in the fourth quarter of 2020 compared to the prior-year quarter, reaching R$1.312 billion. In the whole of 2020, Adjusted EBITDA came to R$4,906 billion, advancing 14% on 2019. Excluding non-recurring effects, adjusted EBITDA was R$1.106 billion in 4Q20 and R$4.700 billion in 2020, represent growth of 15% and 27% on the prior-year periods.

In October, November and December 2020, the Company’s total sales volume, excluding wood, amounted to 941,000 tons, increasing 2% in comparison with the same period of 2019. The result was leveraged by the strong market demand for paper and packaging, as well as the additional volume produced by the mills of International Paper that were merged into Klabin in October 2020, following the acquisition’s conclusion. In 2020, total sales volume grew 7% to 3,558 thousand tons sold, with all business lines reporting growth.

Net revenue in the quarter grew by 22% compared to 4Q19, to R$3.292 billion, setting a new record for the Company, driven by sales volume growth, the weaker Brazilian real against the U.S. dollar and the recovery of prices in paper and packaging markets. In 2020, net revenue was R$11.949 billion, 16% higher than in 2019.

The period results once again demonstrate the Company’s operational flexibility based on an integrated and diversified business model that allows for optimizing production and adapting to different economic scenarios.

Investments

In October, November and December 2020, Klabin invested approximately R$2 billion, with R$134 million allocated to its forestry operations, R$110 million invested in operational continuity and mill maintenance and R$296 million allocated to special projects and expansions, which include payment of the first installment of the asset acquisition from International Paper, in the amount of R$280 million. Disbursements for the Puma II Project in the fourth quarter came to R$1.468 billion, bringing total investment to date in the project to R$5.316 billion. In 2020, the Company’s investments amounted to R$5.174 billion.

Sustainable Development

In the last quarter of the year, Klabin commemorated important achievements that reinforce its efforts to foster sustainable development and demonstrate its evolution in ESG practices. For the eighth straight year, it was selected as a component of the B3’s Corporate Sustainability Index (ISE). It also was selected as a component of the 2020/2021 Dow Jones Sustainability Index in two categories, the World Index and the Emerging Markets Index, making it the only Brazilian company to figure in the World category.

Another important milestone in the period was the launch of the Klabin Sustainable Development Goals (KODS) – 2030 Agenda, which are a set of short-, medium- and long-term targets focusing on environmental, social and governance needs, in line with the Company’s strategic plan and the global urgencies of society and the planet.

pt

pt

en

en

es

es