Press Release

03/05/2022

Relações com Investidores e Resultados Financeiros

Klabin registers 38% growth in Adjusted EBITDA in the first quarter of 2022 and consolidates its trajectory of solid growth in different scenarios

- Adjusted EBITDA in the quarter reached R$ 1.726 billion, up 38% year on year excluding non-recurring effects.

- Net Revenue up 28% year on year, with consistent growth across all business lines.

- In the first quarter, Klabin also extended its Long-Term Incentive Plan to all employees and was recognized as a global benchmark in sustainability by being included in the “The Sustainability Yearbook 2021” index once again.

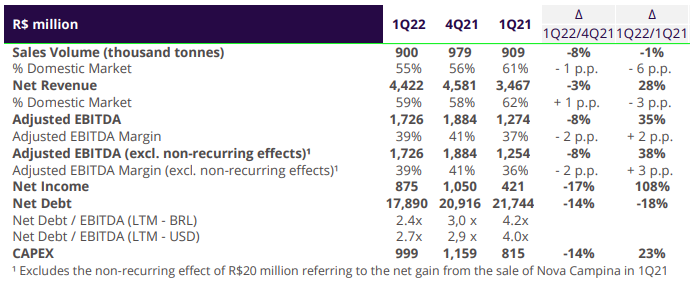

São Paulo, May 3, 2022 - Klabin, Brazil’s largest producer and exporter of packaging paper, the only company in the country to offer solutions in hardwood, softwood and fluff pulp, and the leading producer of corrugated board packaging and industrial bags, has reported 38% growth in adjusted EBITDA (earnings before interest, tax, depreciation and amortization) in the first quarter of 2022 compared to the same period in 2021, amounting to R$1.726 billion excluding non-recurring effects. This performance underlines the Company's ability to deliver solid results in different scenarios.

Sales volume in the first quarter of the year, excluding wood, totaled 900,000 tons, with paper sales growing 24% during the period, driven by the additional output from paper machine 27 (MP27), the first machine of the Puma II Project, which went operational in August 2021. Net revenue totaled R$ 4.422 billion in 1Q22, an increase of 28% from 1Q21, accompanying the price increases in recent quarters across all business units in both the domestic and export markets, and offsetting the impact of a stronger real against the dollar on exports during the period.

Deleveraging was favored by EBITDA growth in the last twelve months and by disciplined capital allocation, which reduced the net debt/EBITDA ratio, in dollar, to 2.7x in 1Q22 (versus 4.0x in 1Q21), even in the midst of the Puma II Project investment cycle. Return on Invested Capital (ROIC) reached 20.1% in the last 12 months, once again proving Klabin's ability to grow while creating value, and the efficiency of its integrated, diversified and flexible business model.

Extension of long-term incentive plan to employees

In an unprecedented initiative among large Brazilian companies, Klabin extended its Long-Term Incentive Plan to all employees in order to further bolster the engagement of employees to the company’s future. Employees can now convert a percentage of their profit sharing (bonus) to buying the shares of the Company, which will pay the matching amount.

Investments

In the first three months of the year, Klabin invested R$ 999 million in its operations and expansion projects, of which R$ 294 million was used to meet the working capital requirements of the forestry operation and the mills. A total of R$ 111 million was invested in special projects and expansions.

For the Puma II Project, the Company invested around R$ 594 million during the period. So far, R$ 8.489 billion of the total planned investments have been invested. Construction work on the second paper machine at Puma II - MP28 - is on track and 32% has already been completed. MP28 is scheduled for startup in the second quarter of 2023.

Sustainable leadership

In recognition of its sustainability initiatives, in the first quarter of 2022, Klabin was listed in the 'Gold' category of the Containers and Packaging sector in the “The Sustainability Yearbook 2021” index compiled by S&P Global, which also publishes the ESG rating that forms the Dow Jones Sustainability Index. This is the second consecutive year that the company is included in the index.

The Company was also recognized by CDP, a non-profit organization that manages a global environmental disclosure system for companies, cities, states and regions, by being included in the Global Supplier Engagement Leaderboard, underscoring its incentive efforts across the production chain to combat climate change.

Financial highlights

#financialresults1T22

pt

pt

en

en

es

es