Press Release

07/02/2024

Relações com Investidores e Resultados Financeiros

Klabin reports Adjusted EBITDA of R$6.259 billion in 2023¹

¹excluding non-recurring effects

- In 4Q23, Adjusted EBITDA reached R$1.620 billion, excluding non-recurring effects.

- Total cash cost per ton decreased 12% in 4Q23 vs. 4Q22.

- Earnings paid in 2023 amounted to R$1.4 billion, representing dividend yield of 5.8%.

- In December 2023, Klabin announced the Caetê Project, in which it will invest US$1.160 billion to acquire 150,000 hectares of forest area located substantially in Paraná, which includes productive area of which 85,000 hectares, as well as 31.5 million tons of wood.

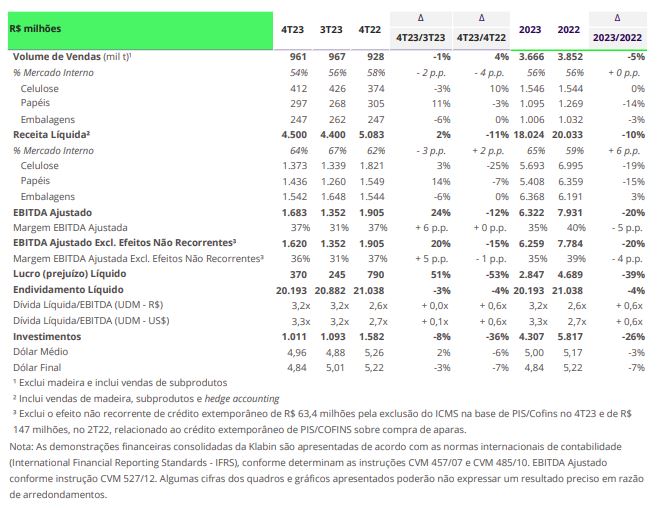

São Paulo, February 7, 2024 – Klabin, Brazil’s largest producer and exporter of paper for packaging and sustainable packaging solutions in paper, has registered Adjusted EBITDA of R$6.259 billion in 2023, down 27% from 2022, after excluding non-recurring effects. Adjusted EBITDA in 4Q23 was R$1.620 billion, excluding non-recurring effects, notably due to the 12% decrease in total cash cost per ton year over year, reflecting the Company’s efforts to improve operational efficiency.

Total sales volume, excluding wood, was 3.6 million tons in 2023. In 4Q23, total sales volume was 961,000 tons, driven by the increase of 10% in the pulp segment and 11% in paperboard sales compared to 4Q22. Paperboard sales volume already reflects the ramp-up pf Paper Machine 28, which started operations in June 2023. As such, Klabin’s net revenue totaled R$18.0 billion in 2023 and R$4.5 billion in 4Q23.

Klabin’s net debt ended 2023 at R$20.2 billion, with net leverage, measured by the ratio of net debt to Adjusted EBITDA in US$, was 3.3x, within the parameters set by the Company’s Debt Policy.

Adjusted Free Cash Flow came to R$3.1 billion in 2023, which represents adjusted FCF Yield of 13.3%. Last year, the Company also distributed earnings totaling R$1.358 billion, equivalent to dividend yield of 5.8%, demonstrating its capacity to create value for shareholders.

Investments

In 2023, Klabin invested R$4.307 billion in its operations and expansion projects, 26% less than in 2022, with R$808 million allocated to silviculture activities; R$879 million to working capital; R$290 million to the acquisition of timber and forest expansion; R$785 million to special projects, mainly Figueira and Horizonte; and R$7 million to preparatory work for replacing the boiler at the Monte Alegre Unit (PR). Investments in the Puma II Project totaled R$1.539 billion in 2023, down 52% from 2022.

Caetê Project

The acquisition of Arauco’s forest operation, announced in late 2023, strengthened Klabin’s commitment to seeking efficiency, this time in the forest area. The investment of US$1.160 billion considers the acquisition of 150,000 hectares of total area located substantially in the state of Paraná, of which 85,000 hectares are productive forest areas, as well as 31.5 million tons of wood.

With this acquisition, Klabin concludes forest expansion for the Puma II Project, reducing the structural average supply radius in Paraná and generating significant gains from operating synergies and reduction of future investments. In addition, after the harvest of the current wood cycle, Klabin will surpass its self-sufficiency target of 75% of own wood in approximately 60,000 hectares of productive area. The operation is still subject to conditions precedent typical to transactions of this type.

Leadership in sustainability

Klabin’s sustainability initiatives were further recognized in 2023 by important global institutions. For the fourth straight year, the Company was included in the global portfolio of the Dow Jones Sustainability Index. It has also been a component of B3’s Corporate Sustainability Index (ISE) for 11 years.

Financial highlights

#Resultados4T23 #Ebitda #Eficiência

pt

pt

en

en

es

es